Frequently asked questions

On this page

About UPP

In a multi-employer JSPP, plan governance, costs and risks are shared equally between employers and members. Both are also jointly responsible for oversight of the plan, including decisions about the terms and conditions of the plan, plan amendments, and appointing a plan administrator.

Several of Ontario’s large public sector pension plans are JSPPs, including the Ontario Teachers’ Pension Plan, OPSEU Pension Plan (OPTrust), HOOPP (healthcare), OMERS (municipal), and CAAT (colleges). These plans are internationally known for their investment expertise and ability to provide secure, high-quality pensions.

We currently serve 16 participating organizations – four universities and 12 other affiliated organizations.

What other plans join, and when, is a decision of the Joint Sponsors. UPP’s job is to be ready, create a platform that will excite plans to join, and make the transition as easy as possible. We will always inform our members when new employers join.

Transition to UPP

To join UPP, you must be in an eligible employment class with a participating university or affiliate organization. Please contact your employer’s pension services team for questions about your eligibility or to discuss new membership.

If you’ve earned pension benefits under a participating university’s prior plan, different early retirement eligibility rules and reductions may apply for that service portion. For more information on the terms of your university’s prior plan, please contact your university pension administration team.

UPP’s Joint Sponsors represent the Plan’s employees and employers and are together responsible for making all decisions about the terms and conditions of the UPP, any amendments (including benefits and contributions), and its funding policy.

The Board of Trustees is the legal administrator of the UPP. Each Sponsor Committee (employee and employer) appoints six Trustees, with the non-unionized trustee being appointed by representatives of the non-unionized employees. The Joint Sponsors together appoint the independent Chair.

UPP members, therefore, have a direct voice at the decision-making table through their representatives on the Joint Sponsors Committee and Board of Trustees.

The diverse perspectives of members are essential to building a strong plan. Throughout 2021 and early 2022, UPP engaged with plan members to understand their expectations, values, and priorities about two core aspects of their pension journey – member experience and the investment of their assets. The collective dialogue helps UPP build to meet members’ needs and helps inform UPP’s strategies and foundations. A summary report on the results and takeaways from those engagements is available here. There you will also find closed-captioned recordings of the live events.

We are committed to maintaining an open, direct dialogue with our members through our engagement program, by sharing news and updates with our subscribers and by encouraging ongoing feedback and commentary through our online feedback form and [email protected]. These communication channels will always remain open, to both hear from you and keep you informed on the changes that impact you most.

Benefits earned under your university’s prior plan will stay the same. See Plan Basics for UPP’s benefit formula.

Yes! Each year, active and deferred members will receive an annual statement providing a snapshot of your benefits, including those from your prior plan benefits (if any), and your earliest unreduced retirement date and normal retirement date. If you are a retired member, you will receive an annual statement outlining the details of your pension.

The date your annual pension statement is released may have changed. UPP’s fiscal year-end is December 31 for all participating universities. Annual statements will be issued no later than six months after UPP’s fiscal year-end or by June 30 each year.

The commuted value is the total estimated value in today’s dollars of the lifetime pension you have earned and would be payable at retirement. It is an actuarial calculation that involves many factors, including your age, your assumed retirement age, mortality rates and interest rates.

Because the commuted value is a current estimate of a future value, the lump sum you may receive based on a commuted value may be greater or less than the actual pension payments that you would have received if you had elected to receive a pension from the Plan.

All pensions earned under a current university plan would be transferred to the UPP, without any changes to pension benefit amounts already accrued.

Members who retire under UPP and have prior service in another university plan will receive a pension based on two parts: one based on the formula in their former plan and the service they accrued under that plan, and one based on the UPP formula and their service accrued under UPP.

Members who have retired under a university pension plan before conversion to the UPP will continue to be paid the same amount of pension after conversion. Their pensions will not be affected by contribution increases, if any, and they will receive the same cost-of-living increases after conversion as they would have under their previous plan.

Yes, under UPP your employee contributions are 100% matched by your employer. See Plan Basics for more.

Your privacy is important to the UPP, and we take the security of your personal information very seriously. At UPP, we:

- Limit the collection of personal information

- Do not sell your personal information to any organization or person

- May share your personal information with third parties and service providers (companies operating on our behalf)

If you are a member of one of the founding universities who joined UPP in July 2021 (U of T, Queen’s, University of Guelph), and you have any questions about your pension plan or benefits, please contact your trusted university pension services team.

If you are a member of a different prior plan, UPP’s Member Services team would be pleased to assist you at Tel: 1 (833) 627-7877 or [email protected].

Plan basics

NOTE: The answers in this section summarize the main features of your University Pension Plan Ontario (UPP) in simple terms. A complete description is contained in the UPP Plan Text, available through your employer or upon request to UPP via email ([email protected]). Every effort has been made to provide an accurate summary. However, if there are any differences between the information given here and the Plan Text, the Plan Text applies.

The best place to start is the UPP Member Handbook, which outlines key information for each stage of your UPP pension journey. If you have questions specific to your individual pension, please contact your university pension services team listed below.

University of Guelph

Tel: (519) 824-4120 ext. 52142

Email: [email protected]

University of Toronto

Tel: 1 (888) 852-2559

Queen’s University

Tel: (613) 533-2070

Email: [email protected]

Trent University

Email: [email protected]

Tel: 1-833-627-7877

If you were earning pension benefits under your university’s prior plan when it converted to UPP, you automatically become a member of UPP on the day your university joins.

New and existing employees not enrolled in a prior plan

To join UPP, you must be in an eligible employment class, which varies by participating university. Please contact your university pension administration team for questions about your eligibility or to discuss new membership.

If you are in an eligible employment class, there are two ways to join the Plan:

Full-Time Continuous Employees automatically join the Plan:

- the first day of the month (or first full pay period if paid bi-weekly) on or following the date you join a participating employer, or

- when you become full-time.

Other than Continuous Full-time Employees – that is, employees of a participating employer who do not qualify as a full-time employee – can choose to join UPP on the first of any month after meeting one of the following conditions:

- you earn at least 35% of the Canada Pension Plan (CPP) earnings limit, also known as the Year’s Maximum Pensionable Earnings (YMPE); or

- you work 700 or more hours in a year.

At least one of these conditions must be met in each of the last two consecutive calendar years before applying for membership.

The YMPE is a threshold set each year by the federal government, based on the average wage in Canada. We use it to calculate your pension and determine how much you need to contribute to the Plan.

The University Pension Plan (UPP) allows funds to be transferred from a previous employer’s registered pension plan to UPP, under certain conditions, to be used to purchase pensionable service in the plan.

If eligible, transferring funds may allow you to:

- Receive additional pensionable service under UPP

- Increase your eligibility service, which may help you qualify for an unreduced, early retirement pension sooner.

Who Is Eligible

If you earned pensionable service with your previous employer immediately before joining UPP, you may be eligible to transfer all or a portion of the value of your benefit entitlement to UPP if all the following apply:

- You stopped being a member of your previous employer’s pension plan within 12 months of becoming a member of UPP (or within 12 months of joining the university’s prior plan, whichever is earlier), and

- You apply for the transfer within 12 months of becoming a member of UPP (or within 12 months of joining the university’s prior plan, whichever is earlier), and

- Your immediately previous employer’s plan is a Canadian registered pension plan (RPP),

- You are entitled to receive a benefit from your previous employer’s plan, and

- Your previous plan allows transfers.

Please note that if you previously initiated a transfer to your employer’s prior plan, you are not eligible for a transfer under the provisions of UPP. UPP does not allow transfers from RRSPs and LIRAs, except as a shortfall payment if the funds in your previous plan are not enough to purchase the full amount of pensionable service in UPP.

Requesting A Transfer

The first step is to complete and return a Pension Transfer Application within 12 months of becoming a member of UPP (or within 12 months of joining your employer’s prior plan, whichever is earlier).

Please keep in mind that the process for requesting and completing a transfer can be lengthy. The table on the next page outlines important items and action steps.

Steps to transfer

| Step | Action |

|---|---|

| Submit an application | Complete and submit a Pension Transfer Application to UPP within 12 months of joining UPP. |

| Request data from your previous pension plan | To process your application, UPP will send a data request to your previous pension plan administrator, which will include a deadline for providing information. |

| Cost quote | Once all the requested data is received, UPP will determine the cost to purchase the pension credits from your prior pension plan in the UPP plan. The cost is the actuarial value of the pension based on UPP’s established administrative guidelines. The maximum UPP service you can purchase is limited to the service you earned in your previous employer’s plan. |

| Review options | A transfer in election package will be sent to you to review the total cost and your payment options. The package will include:

You will have a limited time to review the information and decide if you wish to purchase some, all or none of the pensionable service. If you do not respond by the deadline, your application will be closed and you will lose the opportunity to transfer. Transferring funds from a previous plan to UPP is an important decision. It’s a good idea to seek advice from an independent financial advisor. |

| Transfer funds | Once all the requested data is received, UPP will determine the cost to purchase the pension credits from your prior pension plan in the UPP plan. The cost is the actuarial value of the pension based on UPP’s established administrative guidelines. The maximum UPP service you can purchase is limited to the service you earned in your previous employer’s plan. If you decide to transfer funds from your prior pension plan to the UPP plan, you will contact your prior plan administrator to request a transfer of funds to UPP, along with the required forms from your transfer package. The transfer of funds from your previous pension plan to UPP may take several months to complete. When you transfer pension service, UPP is required to calculate a “past service pension adjustment” (PSPA) and report it to the Canada Revenue Agency for approval. A PSPA represents the value of the pension you wish to purchase. It reduces your RRSP contribution room for the next taxation year. Funds transferred from your prior pension plan, RRSP or LIRA will reduce the PSPA. Shortfall payments If the funds in your previous plan are less than the total cost to purchase the full amount of pensionable service in UPP, you may choose to make a one-time lump sum cash payment and/or transfer funds from an RRSP to purchase the remaining service. No other payment options are allowed. If your payment is not received by the due date indicated in your transfer package, you will only be credited with pensionable service based on the funds received from your previous pension plan. |

| Complete the transfer | Once the payment(s) have been processed, you will be notified that the transfer is complete. You will receive an income tax receipt for any lump sum cash payments. |

For more information

If you have any questions or need additional information, please contact UPP’s Pension Services team.

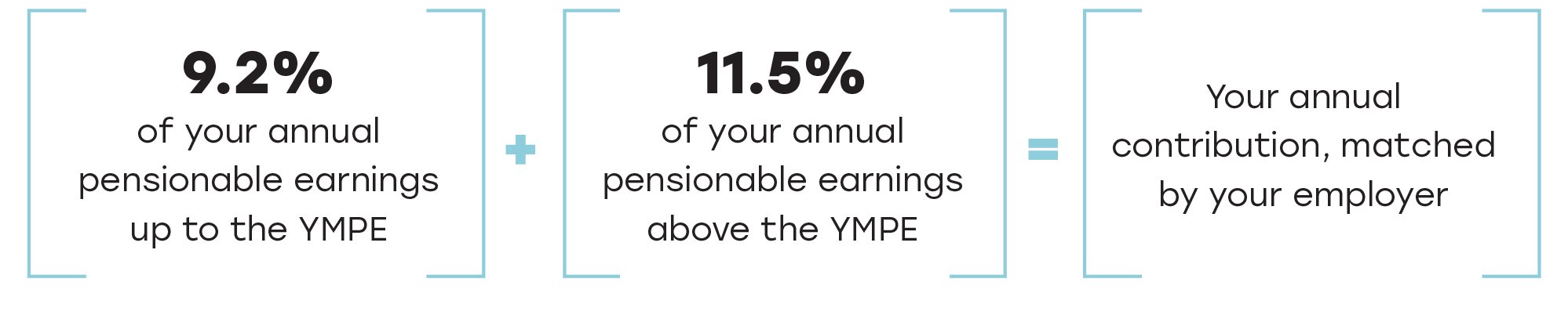

The Plan’s contribution rates are set by UPP’s Joint Sponsors. As a UPP member, you currently contribute:

Under UPP, your annual contribution is determined by taking 9.2% of your annual pensionable earnings up to the YMPE* plus 11.5% of your annual pensionable earnings over the YMPE. Your contribution is 100% matched by your employer * The YMPE is a threshold set each year by the federal government, based on the average wage in Canada. In 2023, YMPE is $66,600.

Different contribution rules apply during certain types of leaves of absence and special programs.

IMPORTANT: Under the UPP, your earnings for contribution formula purposes will be capped at $196,200 (2023) increased annually in line with increases to the maximum pension rules under the Income Tax Act.

Footnote: UPP’s founding Universities are also responsible for any pre-conversion deficit funding, addressed through amortized special payments

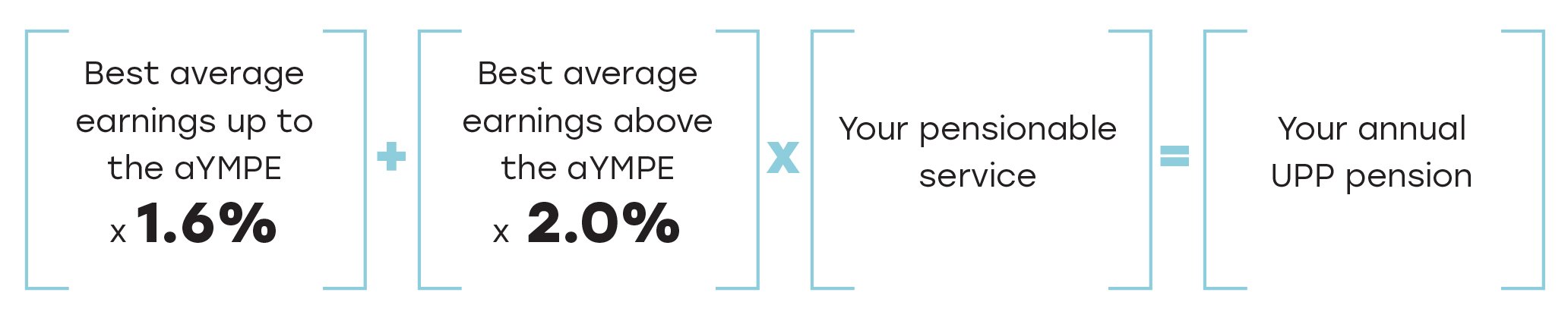

As a member of UPP, your pension is paid for life. The pension you receive is based on a formula that considers a few key components:

Your Best Average Earnings: average of your highest 48 months of pensionable earnings as a member, up to the maximum pension limit under the Income Tax Act.

Average YMPE(1): average of the YMPE established by the federal government in the last 48 months before you retire.

Your years of Pensionable Service: the amount of continuous service during which you’ve contributed to UPP and your prior plan, including any service you transferred in.

For each year of pensionable service after joining UPP, you will accrue an annual pension benefit, payable at your Normal Retirement Date, based on:

(1)Please note that this will change to the Year’s Additional Maximum Pensionable Earnings (YAMPE) for service on and after January 1, 2025. Like the YMPE, the YAMPE is set to increase each year to reflect wage growth in Canada.

Your annual pension benefit, payable at your Normal Retirement Date, based on: your best average earnings* up to the average YMPE** multiplied by 1.6% plus your best average earnings above the average YMPE multiplied by 2%, the total of which is multiplied by your UPP pensionable service *an average of your highest 48 months of pensionable earnings as a member, limited to the amount that would produce the Income Tax Act (ITA) maximum lifetime annual pension ** average of the YMPE established by the federal government in the last 48 months before you retire.

Like all registered pension plans, UPP’s pension benefit is subject to the maximum pension limits under the Income Tax Act.

Under UPP, pension payments are on the first day of the month.

We know projection tools are very important to members and are very helpful to the planning process. These tools are being developed as we build our member service infrastructure and systems.

In the meantime, the universities listed below provide pension calculators on their member portals. You can use your university’s member portal anytime to estimate your future pension, using your own pension data and retirement dates.

University of Guelph

Tel: (519) 824-4120 ext. 52142

Email: [email protected]

University of Toronto

Tel: 1 (888) 852-2559

Queen’s University

Tel: (613) 533-2070

Email: [email protected]

If your employer is not listed above, you can request a projection of your future pension from UPP’s Pension Services team via email – [email protected]

Each year by June 30th, you will receive an annual statement providing a snapshot of your benefits as of December 31st of the previous year. Your statement includes the benefits you earned in your prior plan (if any), and your earliest retirement date and normal retirement date.

If your employer provides a member portal, you can log in and use the pension calculator to estimate your future pension, using your own pension data and retirement dates.

Close to retirement? You can request a personalized pension estimate, which will give you a snapshot of what you can expect to receive in retirement based on your expected plans.

Under UPP, you decide when to start collecting your pension.

The normal retirement date is the end of the month in which you reach age 65, but you can continue to work (and earn pension benefits) up to November 30th of the year you turn 71.

You can retire with an early unreduced pension as early as age 60 if your age plus your eligibility service equal at least 80 points. This is known as the “80 factor.” For example, if you were 62, you would need at least 18 years of eligibility service to qualify for an early unreduced pension (62 + 18 = 80 points). Because of the stipulation that you must be at least age 60 to retire early, a member aged 58 with 22 years of eligible service would not qualify for an early unreduced pension.

You can retire with an early reduced pension as early as the end of the month in which you turn 55. Your pension will be reduced by 5% for each year (prorated for partial years) that you are under age 65. Your pension will be reduced by 5% for each year (prorated for partial years) that you are under age 65. For example, if you decided to begin your pension at age 62.5 with 15 years of eligibility service, your pension would be reduced by 12.5% [65-62.5] x 5% per year). The reduction reflects the fact that by choosing to start your pension at a younger age, you will probably receive your pension for a longer period. In general, your pension starts on the first day of the month following your retirement date.

You can postpone your retirement until November 30th of the year in which you reach age 71. After this date your contributions will stop and you must elect a retirement income option.

If you’ve earned a pension under a participating university’s prior plan, different early retirement eligibility rules and reductions might apply to your prior service. For more information and to get a personalized retirement projection, please contact your university pension administration team.

You can read more about the path to retirement in the Member Handbook.

Inflation protection is a valuable benefit designed to increase the amount of your monthly pension through a cost-of-living adjustment based on the increase in the Canadian Consumer Price Index (CPI).

Prior plans – If your prior plan had inflation protection, it will still apply to your benefits earned under that plan. Prior plans have varying dates and definitions of inflation protection that only apply to benefits earned under those prior plan provisions. Please contact your university pension services team for details.

UPP – When you retire and begin receiving your pension, the portion attributable to UPP benefits will be subject to funded conditional indexation. This means that any indexation adjustments will be determined by UPP’s Joint Sponsors. UPP’s target funded conditional indexation is 75% of the increase in CPI for Canada but may be less based on the Plan’s overall financial health and Funding Policy. Indexation of your UPP benefits is not guaranteed, meaning if an indexation adjustment is made in any given year, it does not necessarily mean an adjustment will be made in any future year.

You can read more about inflation protection in the Member Handbook.

There may be times when your career or life choices alter your earnings or hours worked, which could affect your pension benefits. UPP offers many ways to ensure you continue building benefits and maximize your pension along the way.

During an employer-approved leave of absence, you will remain a member of UPP, but you will only earn pensionable service for that period if contributions are made. The chart below shows the most common type of leaves and how contributions can be maintained.

| Type of Leave | Your Contributions | Your Employer’s Contributions |

|---|---|---|

| Statutory (Ex: parental leave) | Optional – you decide if you want to continue your contributions or not | Your contributions are matched by your employer (as applicable) |

| Unpaid | Optional – you decide if you want to cover your and your employer’s contribution amounts | Your employer does not contribute |

| Paid | Required – contributions continue without interruption | Your contributions are matched by your employer |

| Research & Study | Required – contributions continue without interruption | Your contributions are matched by your employer |

| Long-term Disability | You do not contribute | Contributions will be made by your employer if you are (or would be) eligible for long-term disability benefits |

Please contact your university pension administration team to learn about other leaves of absence and how they might impact your pension.

If you leave for another UPP employer within 12 months of the date your employment ended, and you didn’t transfer any of your pension assets in your departure, your contributions will simply begin again, your memberships will combine, and your pension will be recalculated when you retire or leave for a non-UPP employer.

If you leave your job with a UPP employer, you will need to decide what to do with your UPP pension. You will receive a statement of options*, as summarized below:

For members under age 55, you can:

- leave your benefits in the Plan until you become eligible to retire (the default option) or,

- transfer the commuted value of your UPP pension to a registered retirement vehicle (such as an RRSP) or another pension plan or purchase an annuity through an insurance company. This is a time-limited, final settlement of your UPP pension. If you rejoin UPP at a future date, you cannot put the money back into the plan and your previous service and earnings will not be used to determine your eligibility to retire or the amount of pension you will receive.

For members aged 55 or older, you can:

- leave your benefits in the Plan until age 65 or,

- take an immediate pension.

You should always seek independent professional financial advice when making decisions about your UPP pension.

*Please note that if you happen to rejoin UPP before receiving your termination options package, re-entering the Plan becomes your ‘default’ selection and a lump-sum transfer is no longer available.

Your pension does not begin until you provide your employer with the necessary documentation and notice of your decision to retire. Documentation and notice requirements vary by participating employer and you should consult your university pension administration team on what those are.

There may be impacts on your pension if you return to work for a participating UPP employer after you start collecting a pension.

If you return to work for a participating UPP employer (in an eligible employment class) on a continuous full-time basis, your pension payments will stop and you will become a contributing member of UPP. You’ll build additional benefits and your pension will be recalculated when you retire again.

If you return to work for a participating UPP employer (in an eligible employment class) on a basis other than continuous full-time, you will have the option to continue receiving a pension, or to stop your pension payments and become a contributing member of UPP.

If you decide to start contributing to UPP again, you will build additional benefits and your pension will be recalculated when you retire again. If not, you will continue collecting your pension and working, but will not accrue any further service under UPP.

If you return to work for a non-UPP employer, there is no impact to your pension.

Survivor benefits are an important feature of the Plan, to help provide for your loved ones when you pass away, whether before or after retirement. Completing the Beneficiary Designation Form when you join the Plan helps ensure the right benefits are provided to the right people. The form is available from your university pension administration team.

If you have a spouse, as defined by the Plan, that person is automatically entitled to your death benefits unless they sign a waiver.

If you do not have a spouse or your spouse waived their rights to survivor benefits, you can designate a beneficiary to be next in line for death benefits. If you do not have a spouse or a beneficiary, this money will be paid to your estate.

Please see UPP’s Member Handbook for more information, or speak to your trusted university pension administration team.

If you leave your employment with an employer who participates in UPP and move to an employer who does not participate in UPP, neither you nor your new employer can make contributions to UPP.

Your UPP pension is determined by a formula that is based on your pensionable earnings and service. The longer you work and contribute to UPP, the more pensionable service you will have and the bigger your pension will be.

You can retire with no reduction to your pension at any time after reaching the Normal Retirement Date or UPP’s Early Unreduced Retirement Date, whichever is earlier.

The Normal Retirement Date is the last day of the month in which you turn 65. The Early Unreduced Retirement Date is the day your age and your eligibility service is 80 or more and you are at least 60 years of age.

You can retire as early as age 55, but if you have not yet reached your Early Unreduced Retirement or Normal Retirement Dates, your pension will be reduced by 5% for each year you are under age 65.

If you pass away before retirement, your beneficiary will receive the commuted value of your pension. The commuted value is the lump sum value of your pension that would be payable at retirement calculated in accordance with Ontario pension standards legislation.

If you pass away after retirement,, UPP’s normal form of pension for a member without a spouse is a lifetime pension for you with a 10-year guarantee. This means if you retire and pass away before receiving a total of 120 monthly payments, the balance of payments will be paid to your beneficiary.

If you have more than one beneficiary, the benefit will be split in percentage shares you designate. If you do not have a beneficiary, the benefit will be paid to your estate.

The commuted value is the total estimated value in today’s dollars of the lifetime pension you have earned and would be payable at retirement. It is an actuarial calculation prescribed by pension standards legislation that involves many factors, including your age, your assumed retirement age, mortality rates and interest rates.

Because the commuted value is a current estimate of a future value, the lump sum you may receive based on a commuted value may be greater or less than the actual pension payments that you would have received if you had elected to receive a pension from the Plan.

In Ontario, all members of a registered pension plan (like UPP) are vested immediately upon joining the plan.

No, the UPP does not allow for additional voluntary contributions.

You can only use funds from a registered retirement account, such as an RRSP, to pay for a transfer in “shortfall”. A shortfall occurs if you transfer in service from a prior employer’s pension plan and that plan does not have sufficient funds to satisfy the UPP cost.

Investments and ESG

Statement of Investment Policies and Procedures, or SIPP, is a regulatory document required under the Ontario Pension Benefits Act for all registered pension plans.

As its names suggests, a pension plan’s SIPP contains information about the investment policies and procedures that it follows in administering its investment portfolios. It covers information such as the categories of investments and credit vehicles used by the pension fund, the diversification of the portfolio, the asset mix, and rate-of-return expectations, as well as the liquidity of the investments (i.e., how easily they can be sold).

The SIPP also covers fund governance, funding valuations and how environmental, social and governance (ESG) factors are incorporated. The ESG requirement came into effect in 2016.

UPP’s Board of Trustees, as the Plan’s legal administrator, must file the SIPP with the Financial Services Regulatory Authority (FSRA) within 60 days of plan registration, which occurred on July 1, 2021. FSRA is Ontario’s pension regulator.

UPP’s SIPP replaces the SIPPs of any participating pension funds. It reflects our investment and asset position at the Plan’s inception. It will be revisited at least annually and adapted as necessary. Amended versions will be posted accordingly.

Read our Statement of Investment Policies and Procedures [PDF].

We apply a number of measures and tools to maximize the Plan’s funded status and stability while maintaining stable, sustainable contribution and benefit levels over time.

One such measure is an innovative risk-sharing mechanism where all new plans entering UPP must be fully funded or establish a payment schedule to become fully funded over an agreed-upon initial period, subject to pension legislation. Over the long term, Plan risks – including funding risk – are shared equally and addressed jointly between Plan members and employers. This phased mechanism was designed specifically to ensure no negative impact to existing members from new organizations coming into the Plan.

Meanwhile, our investment program is specifically designed to meet our pension commitments over the long term, with a core focus on promoting the health of the fund and the broader market environment on which the fund relies. As a long-term investor, our investment risk programs are designed to buttress our fund from short term market shocks.

Responsible investing is the integration of ESG (Environmental, Social and Governance) considerations into the investment processes and stewardship practices of an organization. Responsible investing focuses on those factors that could have a material impact on financial performance and environment, social and financial systems.

At UPP, we use a variety of approaches to embed ESG into our actions and activities to improve our investment outcomes. This ensures we consider the real and evolving impacts of these factors as seriously as other metrics when we decide what to buy, sell and hold –and when we communicate our performance and reporting expectations to the companies we’re invested in. We don’t see this as a separate concept from investing. Instead, we view responsible investing as, simply, investing.

ESG refers to environmental, social, and governance factors that may impact or be impacted by corporate or investment activities. Environmental factors relate to the quality and functioning of the natural environment and natural system. Social factors relate to the rights, well-being and interests of people and communities (e.g., employees, customers, broader society). Governance factors relate to the policies and procedures used to direct, control, and monitor companies and other investee entities.

Examples of ESG factors that may be considered by UPP include:

Environmental

- climate change

- greenhouse gas (GHG) emissions

- water and air pollution

- biodiversity

- natural capital

- resource use and efficiency

Social

- human rights and labour rights in operations and supply chains

- equity, diversity, and inclusion

- employee health and safety

- data privacy

- consumer protection

Governance

- board structure and diversity

- executive compensation and link to ESG performance

- shareholder and stakeholder rights

- corporate oversight and risk management

- cybersecurity

- conflicts of interest

- anti-bribery

- corruption

Our leadership team recognizes ESG is a critical lens for its decision-making over time. It not only aligns with our core values, but with our mission to secure sustainable pensions for the long-term.

We also understand that investors have a responsibility to not only respond to evolving environmental, social and governance issues, but also to promote a just, sustainable economy and society. We do not, and will not, take that responsibility lightly.

Since our launch in July 2021, UPP has been building our responsible investment foundation, for example by developing our inaugural Responsible Investing Policy, becoming a founding participant in Climate Engagement Canada, and signing the Canadian Investor Statement on Climate Change. The latter includes a commitment to develop a climate action plan to support the global goal of achieving net-zero emissions by 2050 or sooner, which aligns with the commitment in our Responsible Investing Policy to set climate science-aligned targets to reduce our portfolio emissions profile.

In early 2022, we hosted a series of member-focused discussions on the questions and issues that UPP should address on our responsible investment journey. We also launched part two of our member survey, specifically focused on responsible investment. The 2021-2022 member engagement results, as well as recordings of the sessions, can be found on our Member Engagement page.

Yes, it will. Social and governance issues can also pose significant investment risks and investments can cause adverse impacts on people and communities. We will be taking these into consideration in developing our core investment approach.

Our first Responsible Investing Policy (RI Policy) is available on our Investment Policies page along with our initial Statement of Investment Policies & Procedures (SIPP). The RI Policy is our mechanism for implementing the high-level commitments and beliefs summarized in our SIPP. It provides a starting framework for how we will practically, consistently and comprehensively incorporate ESG considerations in our investment management and stewardship activities.

As we continue to build out our approach, we are committed to ensuring our goals are backed by clear plans and timelines and measurable targets. This is what our members expect of us, and it is one of the important tasks in front of us now, led by our Managing Director of Responsible Investing and sector veteran, Brian Minns. We are committed to investing in a manner that is transparent and can be assessed by you, our members.

We understand that we can achieve more working with others than we can working alone. That is why collaboration is one of our key pillars as an organization. For example, as a member of the Responsible Investment Association (RIA), we continue to work closely with other pension plans on investment best practices, advocacy and good governance.

We also understand the importance of working in partnership with academia, businesses and other investors to help build a truly sustainable approach to investing. Through our relationship with Shareholder Association for Research and Education (SHARE) for example, we’re able to advocate for better corporate sustainability practices and promote greater transparency and accountability across capital markets.

Yes, we have set an ambitious target of net-zero portfolio greenhouse gas emissions by 2040 and will use a range of tools to reach that target. We believe that net-zero by 2040 is the right approach to fulfill both our climate and pension goals.

Our Climate Action Plan outlines the steps and milestones we need to hit along the way to achieve net-zero.

Net-zero greenhouse gas emissions will be achieved when the human-caused emissions associated with our investments are as close to zero as possible and the remainder of human-caused emissions are removed from the atmosphere.

Our planned commitment applies to UPP’s investment portfolio for now, with the goal of including our own operations as we get measurements in place.

While divestment from an entire industry is a fast way to remove assets from a portfolio, it can result in passing ownership of such assets to someone who might care less about their real-world impacts.

We want to support the transition to a net-zero society and address the greenhouse gas emissions from the companies we invest in – transforming the economy toward a better, more resilient state. This takes time and a range of approaches, including targeted exclusions.

We will stay at the table and hold companies accountable for making real progress on decarbonization. If a company is resistant to change and other measures are not encouraging improvements, we believe selling or excluding assets can be appropriate – but we will not apply a pre-emptive, blanket policy of divestment.

Our job is to build a fund that is resilient and responsive to ALL types of risk and opportunity – with sustainable pension security at the core of everything we do. Doing this with an lens helps to better assess and create sustainable value, identify opportunities, and drive stronger long-term financial performance. We will use a variety of tools, including:

- Integrating ESG considerations into investment analysis and decisions, including when selecting, appointing, monitoring, and engaging with external managers

- Being active owners and engaging in ESG stewardship activities, including issuer engagement, industry collaboration and proxy voting

- Integrating evaluation of climate change risk and opportunity into investment management and stewardship practices

Further information on the tools we use in our investment activities can be found in our Responsible Investing Policy.

Responsible investing requires a range of tools to be successful, including engagement. As part of our inaugural investment activities, UPP joined shareholder and investor groups to help amplify our voice on key areas of focus.

You can read more about the tangible and positive impacts of those engagement activities below:

UPP’s Investment Exclusion Policy and our Investment Exclusion List are available on our Investment policies, reports and submissions page. Exclusion means that certain industries or companies are purposely omitted from our investment portfolio because they will not help us meet our investment objectives.

Our reporting of scope 3 emissions is limited by the availability and quality of disclosures by those companies we invest in. Our first carbon footprint report will be focused on scope 1 and 2 emissions but will include scope 3 for energy and mining companies. We expect to see increasing disclosure of scope 3 emissions in the future.

- Scope 1 – direct greenhouse gas emissions from sources a company directly owns or controls

- Scope 2 – indirect greenhouse gas emissions associated with the electricity or heat a company consumes

- Scope 3 – indirect greenhouse gas emissions associated with a company’s value chain, for example emissions associated with products from a supplier, and emissions from its products when customers use them

At UPP, responsible investing is simply how we invest – it is not independent from our approach to investing. Our job is to build a fund that is resilient and responsive to all types of risk and opportunity – with sustainable pension security at the core of everything we do.

It’s our data-driven view that the world is becoming more focused on issues such as climate change or changing demographics – it’s in the best financial interest of the fund to be part of that change. Ultimately, ESG integration is about using research, data and insights to inform better long-term investment decisions. We believe that a just and sustainable society and economy will provide the right environment to ensure our ability to meet the pension promise for our current and future members.

More information about our responsible investment approach, including our responsible investment beliefs, can be found in our Responsible Investing Policy.

Transparency is fundamental to how we do business at the UPP and building trust with our members.

You can view our 2022 Annual Report, which includes comprehensive disclosure related to the Plan’s investment performance and our use of external managers, balancing transparency with confidentiality and other obligations of UPP.

UPP’s carbon footprint metrics can be found in our Climate Action Plan.

At UPP, we are deeply committed to equity, diversity, inclusion and reconciliation. We recognize that one way in which we live out our commitment is by reflecting the rich diversity of the population at all levels within our organization. To that end, UPP a gender, sexual orientation and racially diverse executive team and employee group.

In 2022, we conducted a diversity survey of our team to understand our current make up, identify any gaps in representation and inform strategies to address those gaps. In addition, UPP has a board -approved roadmap that outlines the steps that UPP will take over the next three years to increase diversity and promote inclusion within UPP’s workforce. Our goal is to ensure that its culture, programs and decision-making processes are not only bias-free, but actively benefit from diverse perspectives and lived experiences. We are building an organization wherein everyone is welcome and can thrive.

Equity, diversity, inclusion and reconciliation are an important part of who we are and what we do at UPP. As an organization, we are committed to taking action respectfully and intentionally as outlined in Call to Action #92 from the Truth and Reconciliation Commission of Canada. As we learn, we continue to seek ways we can help address the barriers faced by Indigenous peoples and support a more positive chapter in the relations between indigenous peoples and non-indigenous Canadians. Through our association with the Shareholder Association for Research and Education (SHARE), companies in UPP’s investment portfolio are being engaged in outcome-focused dialogues to make tangible commitments to reconciliation, including the adaption of Indigenous rights policies, employment targets and procurement from Indigenous-owned businesses.

Submit a question

Submit your question through the form below or email: [email protected]

To protect your privacy, please do not enter your account or personal information.

Our company

Member resources

Join the conversation