Feedback

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

Climate Action Plan Progress Highlights

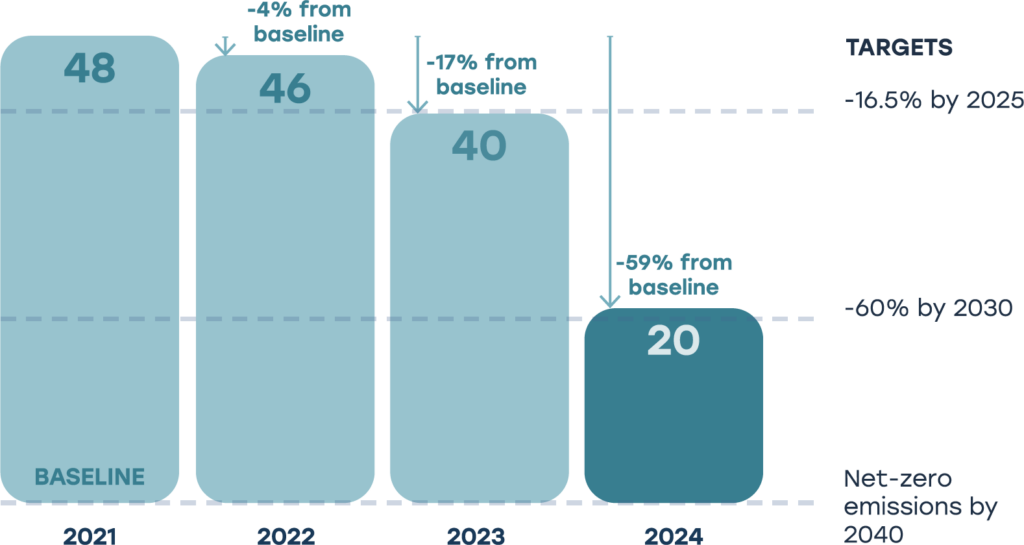

Portfolio GHG emissions intensity reduction

To track our progress against our net-zero commitment, we annually calculate and report the emissions associated with our investments. UPP’s portfolio GHG emissions intensity ended 2024 at 20 tonnes CO2 e/$M invested, down 59% from our 2021 baseline and far exceeding our 2025 target.

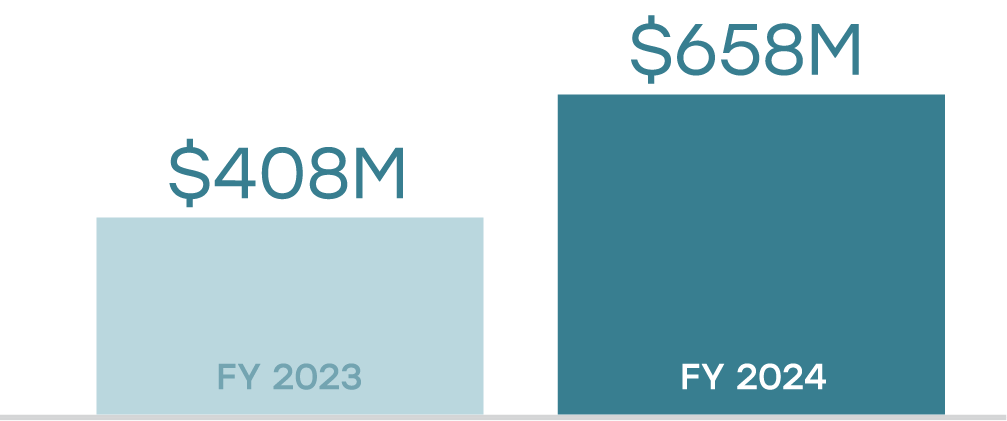

Climate solutions commitments

Since 2023, UPP has committed $650 million to climate solutions, making good progress toward our goal of committing $1.2 billion to climate solutions by 2030. This target includes new commitments to funds across several public and private asset classes, as well as direct investments or co-investments, which can be classified as a climate solution according to our Climate Transition Investment Framework.

UPP’s Climate Transition Investment Framework is an essential foundation to our net-zero strategy that will enable us to systematically evaluate the transition alignment and readiness of our current portfolio and new investment opportunities.

Engaging companies to drive credible climate plans and disclosures

Participation in the UN-convened Net-Zero Asset Owner Alliance

UPP joined the UN-convened Net-Zero Asset Owner Alliance (NZAOA) in 2022, fulfilling a key commitment from our Climate Action Plan. The NZAOA comprises the global institutional investors committed to transitioning their investment portfolios to net-zero GHG emissions by 2050. Our continued participation in the NZAOA in 2024 amplified our message through industry positions, guidelines, and collaborative efforts to address the challenges external managers face and provide clarity on the needs of asset owners.

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

Customize your experience through accessibility adjustments