Feedback

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

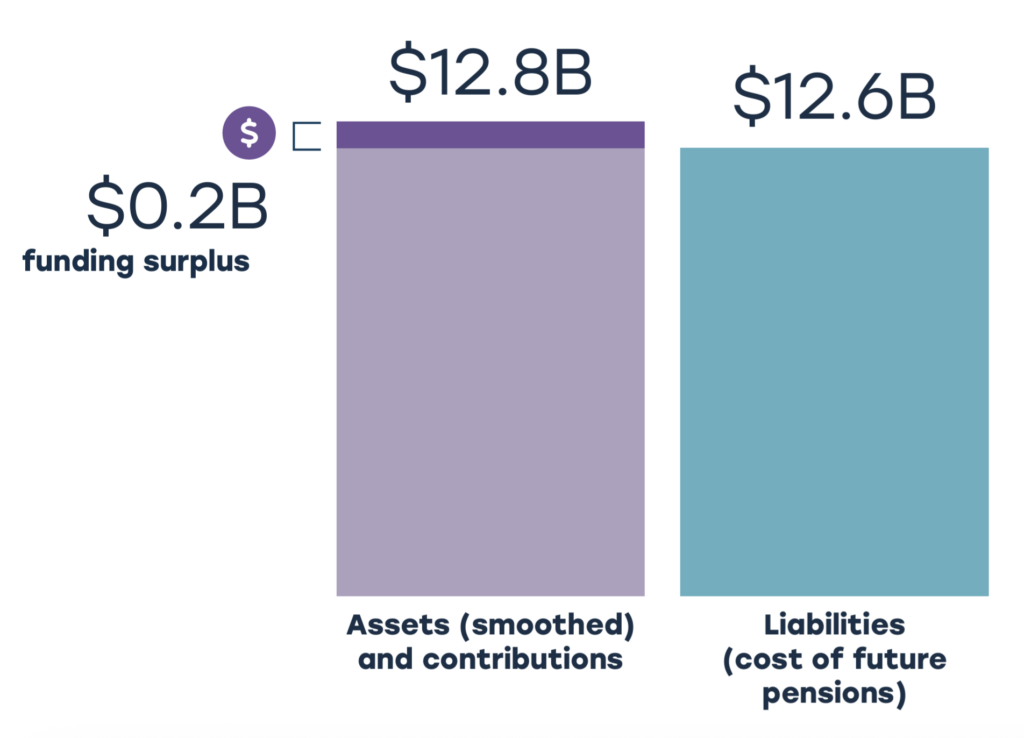

102%

Funded*

$0.2B

Funding surplus*

5.45%

Discount rate

$564M

Paid in pension benefits

Funded status at December 31, 2024

We use various measures and tools to maximize the Plan’s funded status and stability while maintaining stable, sustainable contribution and benefit levels over time, including:

Every three years, at a minimum, UPP must file a funding valuation with regulators showing the Plan’s funded status and contribution requirements. Actuarial valuations provide point-in-time assessment of the Plan’s financial health, based on a range of assumptions and in line with the Canadian Institute of Actuaries’ standards about future trends and events. Regardless of whether a valuation is filed in a given year, UPP produces an annual funding valuation to maintain a line of sight into the Plan’s financial health and to support the Sponsors’ decision-making and discloses this information in our annual report.

UPP uses comprehensive asset-liability modelling to identify challenges and develop strategies to manage the Plan’s long-term investment and funding dynamics. These AL studies bring together all important aspects of the Plan to simulate possible funding outcomes under thousands of economic scenarios. Unlike the typical three- to five-year cycle followed by similar-sized organizations, UPP conducts comprehensive asset-liability modelling internally whenever necessary. Regular asset-liability modelling allows us to stay ahead of potential challenges that could impact our sustainability. It also helps us closely align the investment portfolio with the pension commitments it is built to fund and to project and manage the Plan’s long-term contribution requirements, funded conditional indexing, and benefits. All these aspects help maintain the Plan’s stability over time.

The Joint Sponsors’ Funding Policy guides decisions related to Plan design and risk sharing. It was designed specifically to support long-term Plan sustainability by maintaining stable contributions, protecting benefit security, and ensuring fairness across generations of members. Grounded in strong actuarial and economic principles, the policy includes specific measures to help keep contributions and benefit levels stable while promoting overall Plan health.

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

Customize your experience through accessibility adjustments