Feedback

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

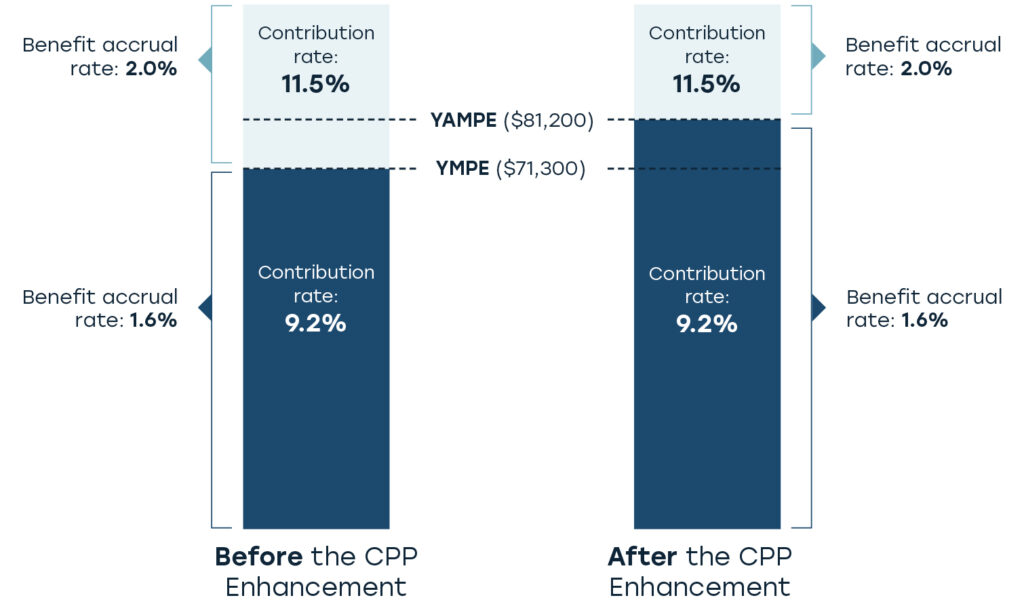

The YMPE is the maximum salary amount on which you contribute to CPP, as set out by the federal government. Learn more about the CPP enhancement at Canada Pension Plan (CPP) and the CPP enhancement – Canada.ca.

This change requires employees and their employers to contribute to CPP at two levels: 5.95% of earnings up to the YMPE, and 4% of earnings up to the YAMPE. This enhancement will increase retirement pensions, disability pensions and survivor pensions that are payable from CPP.

To estimate your CPP pension, visit canada.ca

The CPP change impacts only a small portion of your UPP pension. It does not impact your UPP contributions or pension benefit for your earnings up to the YMPE or above the YAMPE (if applicable).

For the portion of your earnings between the YMPE ($71,300) and YAMPE ($81,200), your UPP contributions and corresponding pension benefit will decrease slightly, while the increase in your CPP contributions and corresponding CPP pension will increase slightly. Individual impacts may vary.

UPP uses a two-tiered formula to calculate your UPP contributions. Up to December 31, 2024, contributions are 9.2% on earnings up to the YMPE limit and 11.5% above it. Effective January 1, 2025, the YAMPE will replace the YMPE in calculating UPP contributions.

This means for service on and after January 1, 2025, active members will contribute 9.2% of their earnings up to the YAMPE, and 11.5% of their pensionable earnings above the YAMPE.

The example below is for illustrative purposes only and does not reflect real data.

Member’s annualized pensionable earnings = $100,000

YMPE = $68,500

YAMPE = $81,200

Annual contributions when the YMPE is used

$68,500 X 9.2 = $6,302.00

$31,500 X 11.5 = $3,622.50

Total contributions = $9,924.50

Annual contributions when the YAMPE is used

$81,200 X 9.2 = $7,470.40

$18,800 X 11.5 = $2,162.00

Total contributions = $9,632.40

As indicated above, the introduction of the YAMPE results in more of the member’s pensionable earnings being calculated at the lower rate, resulting in a lower overall contribution.

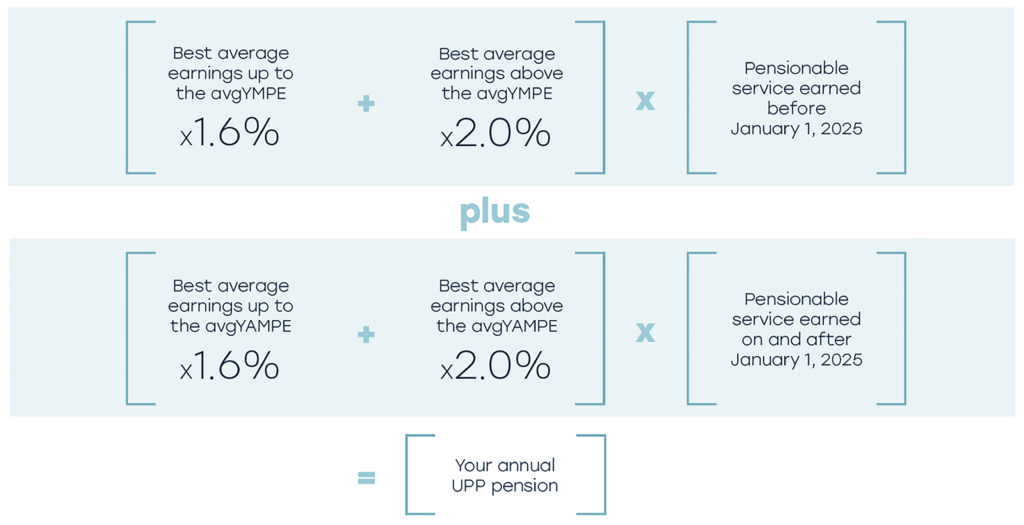

The average YAMPE (avgYAMPE) will replace the average YMPE (avgYMPE) in UPP’s pension formula for any service earned on and after January 1, 2025. For those with service before and after January 1, 2025, this means there are now two layers of calculation to your pension.

The example below is for illustrative purposes and does not reflect real data.

Member’s gross annual pension using the YMPE and YAMPE = $25,636

([68,500 X 1.6%] + [31,500 X 2.0%] X [10 years]) plus ([81,200 X 1.6%)] + [18,800 X 2.0%] X [5 years])

([1,096 + 630] X [10 years]) plus ([1,299 + 376] X [5 years])

17,260 plus 8,376 = $25,636

Member’s gross annual pension when only the YMPE was used = $25,890

([68,500 X 1.6%] + [31,500 X 2.0%]) X 15 years

[(1,096 + 630)] X 15 years

1,726 X 15 years = $25,890

The introduction of the YAMPE results in a slight decrease to your pension amount because a higher amount of your pensionable earnings are calculated at the lower rate of 1.6%. As noted above, this decrease will, however, be at least partially offset by an increase to your CPP pension.

To learn more about your CPP pension, visit canada.ca/en/services/benefits/publicpensions/cpp/cpp-benefit/amount.

Should you have any questions, please contact UPP Member Services via secure message through the myUPP Member Portal or call us at 1-833-627-7877.

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

Customize your experience through accessibility adjustments