Feedback

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

UPP is a defined benefit (DB) pension plan. The pension you receive is based on a formula that considers a few key components including your earnings and years of service. The investment earnings of the plan, as well as the contributions made by you and your employer, are what fund your pension.

The amount you contribute to the plan each year is based on your pensionable earnings, the average YAMPE (a threshold set each year by the federal government, based on the average wage in Canada) and UPP’s contribution rate. Your employer contributes an equal amount. Contributions flowing into the plan are invested by investment professionals bound by fiduciary duty to act in your best interests.

As a UPP member, you currently contribute:

The plan’s contribution rates are set by UPP’s Joint Sponsors and are subject to change based on the plans’ financial status.

Under UPP, your annual contribution is determined by taking 9.2% of your annual pensionable earnings up to the YAMPE plus 11.5% of your annual pensionable earnings over the YAMPE. Your employer matches 100% of your contributions.

The YAMPE is a threshold set each year by the federal government, based on the average wage in Canada. In 2025, the YAMPE is $81,200.

Different contribution rules apply during certain types of leaves of absence and special programs.

IMPORTANT: Under UPP, your earnings for contribution formula purposes will be capped at $215,300 (2025) increased annually in line with increases to the maximum pension rules under the Income Tax Act.

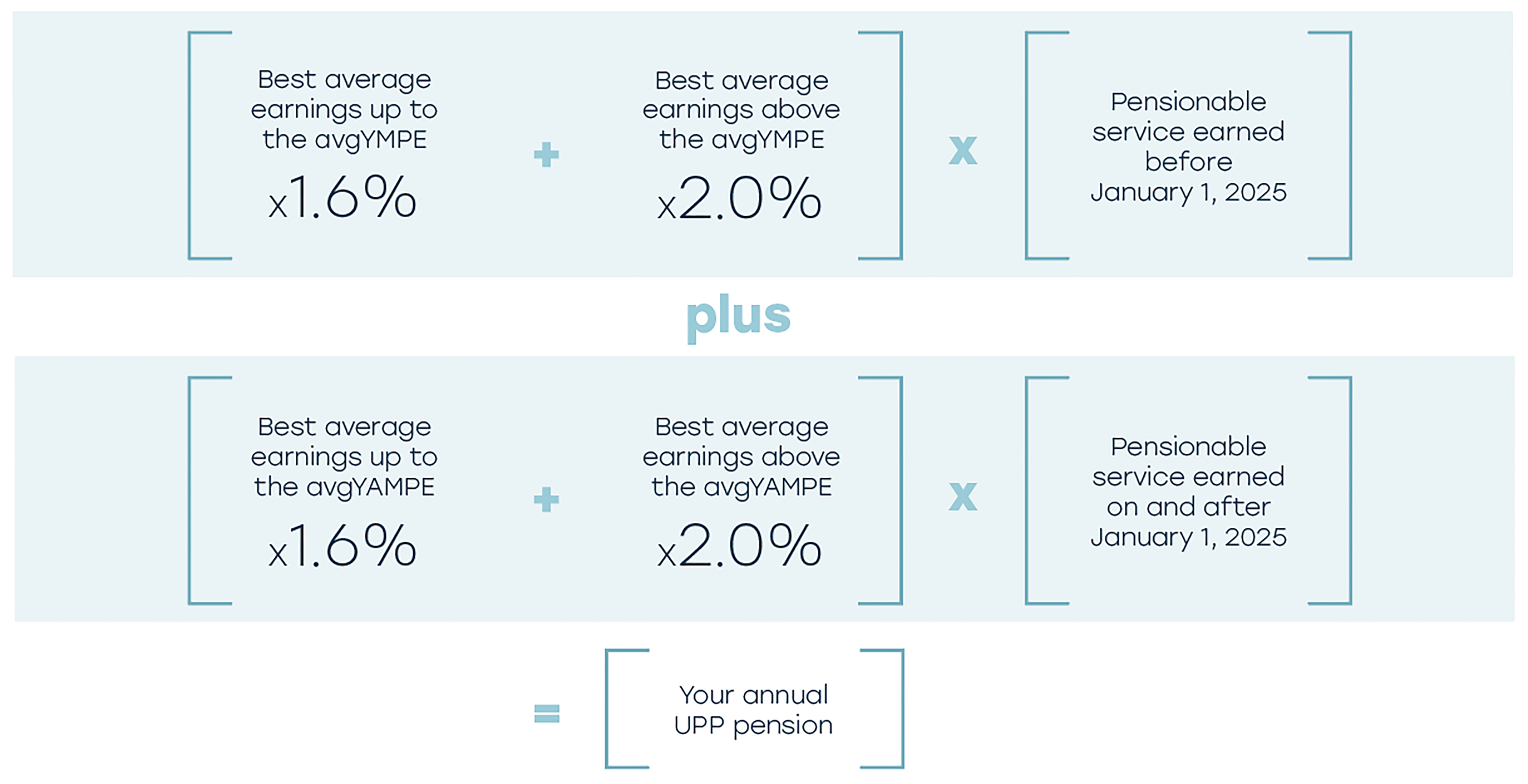

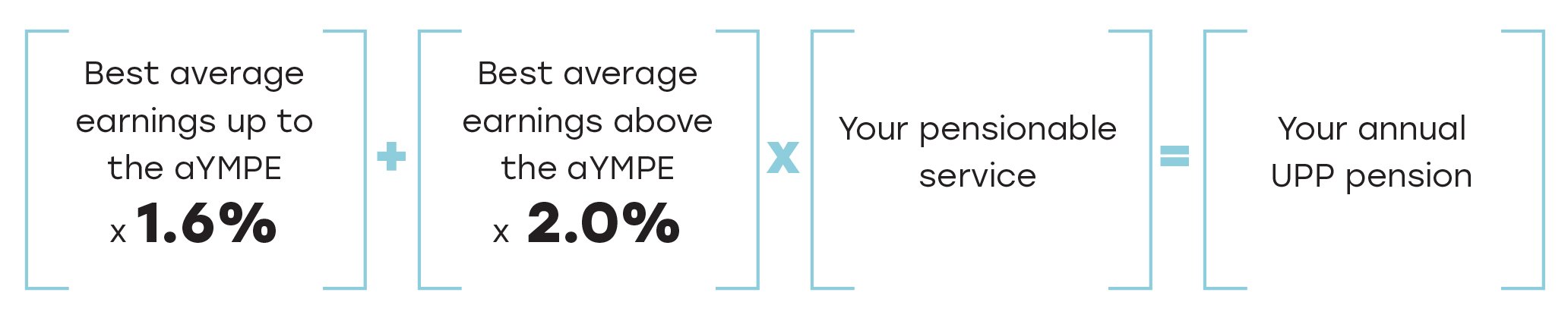

As a member of UPP, your pension is paid for life. The pension you receive is based on a formula that considers a few key components:

Your Best Average Earnings: average of your highest 48 months of pensionable earnings as a member, up to the maximum pension limit under the Income Tax Act.

Average YMPE: average of the YMPE (Year’s Maximum Pensionable Earnings) established by the federal government in the last 48 months before you retire. For service earned before January 1, 2025, the YMPE is used.

Average YAMPE: average of the YAMPE (Year’s Additional Maximum Pensionable Earnings) established by the federal government in the last 48 months before you retire. For service earned on and after January 1, 2025, the YAMPE is used.

Your years of Pensionable Service: the amount of continuous service during which you’ve contributed to UPP, including any service you transferred in.

For each year of pensionable service after joining UPP, you will accrue an annual pension benefit, payable at your Normal Retirement Date.

Like all registered pension plans, UPP’s pension benefit is subject to the maximum pension limits under the Income Tax Act, which increases annually.

UPP provides personalized information that makes it easy to see how much your monthly pension would be at various retirement dates. You can see this information in:

The myUPP Member Portal Pension Estimate Calculator continues to be rolled out in phases over the coming months. You’ll receive an email notification as soon as it’s available to you. Learn more.

If you were earning pension benefits under your university’s or employer’s prior pension plan when it converted to UPP, you automatically become a member of UPP on the day your university or employer joins. Pension benefits earned under your prior plan remain unchanged and are now payable from UPP.

Please refer to your university’s UPP Quick Guide for information on how the pension benefits earned under both your prior plan and UPP work together to provide you with a secure retirement benefit when you retire.

No, UPP does not allow for additional voluntary contributions.

You cannot stop your contributions upon transitioning from full-time to part-time. Once you have started contributing to the Plan, you continue to make contributions until your employment ends.

Your pension is calculated using the same formula as a full-time member. The pension formula uses your average annualized pensionable earnings and your pensionable service.

Annualized earnings are earnings that you would earn in a year if you were working on a full-time basis. For example: if you work 20 hours per week (50% of the full-time equivalent) and earn $35,000.00 annually, your annualized earnings would be $70,000.00 and your pensionable service would be 0.5 years of service to reflect your actual working hours.

For more information, please see page 10 of UPP’s Member Handbook.

No, while retirement savings vehicles like an RRSP may be accessed through programs like the Home Buyer’s Plan, funds in a defined benefit (DB) plan are locked in and cannot be withdrawn for that purpose. A DB pension plan is designed to provide you with a predictable and secure monthly lifetime pension.

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

Customize your experience through accessibility adjustments