Feedback

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

When UPP began assuming management for the pension assets of participating organizations in July 2021, we identified opportunities within the combined portfolio to enhance long-term performance. As a result of our findings, we developed a multi-year transition plan toward one unified and cost effective portfolio tailored to UPP’s funding objectives and investment beliefs.

UPP’s target asset mix is specifically designed to fund our pension benefits for the long term. It will help us maintain a healthy funding and liquidity position, stay well-equipped to pay members’ pensions, and remain agile to investment opportunities as markets evolve. The pace at which UPP can shift toward our target asset mix depends on both structural and transitionary elements, including market movement, liquidity, available investment opportunities, and the duration of investment commitments within the original portfolios. For more information on our target asset mix see our:

Where we're headed

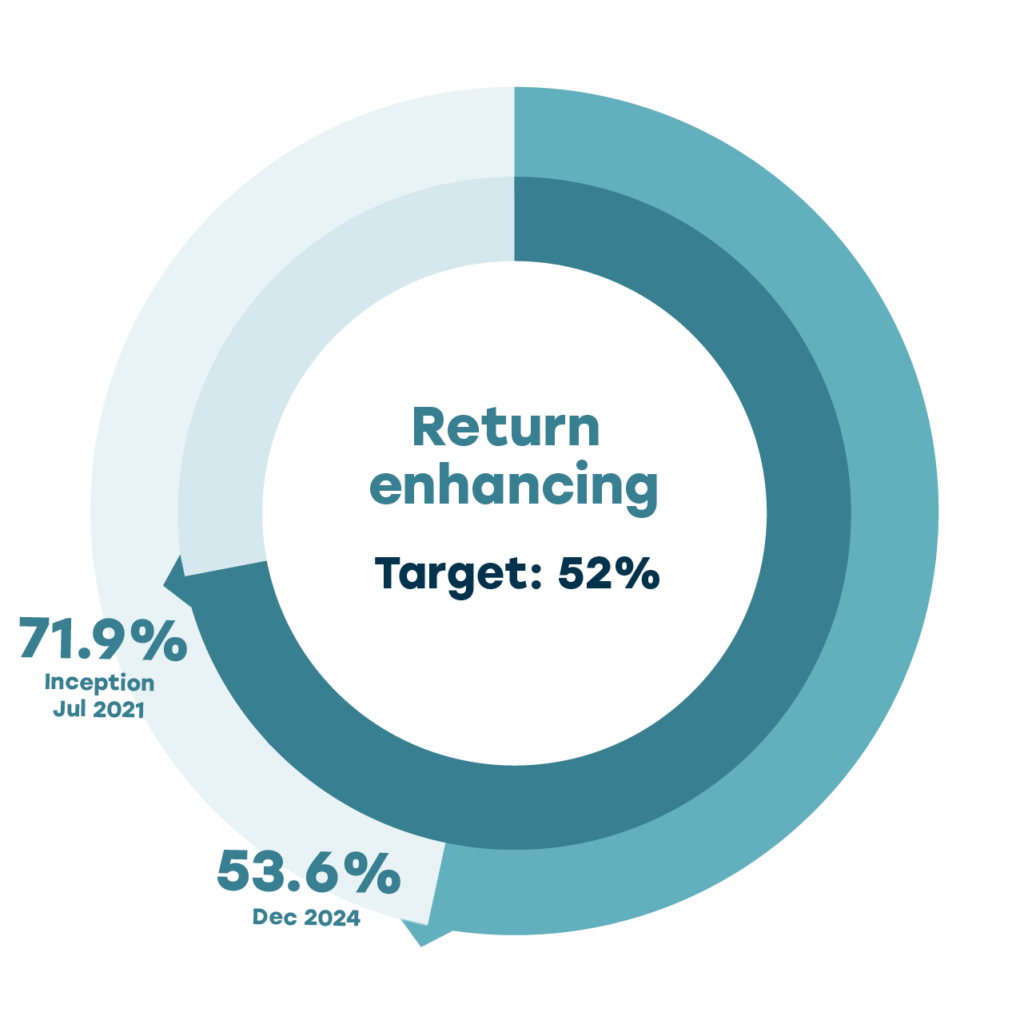

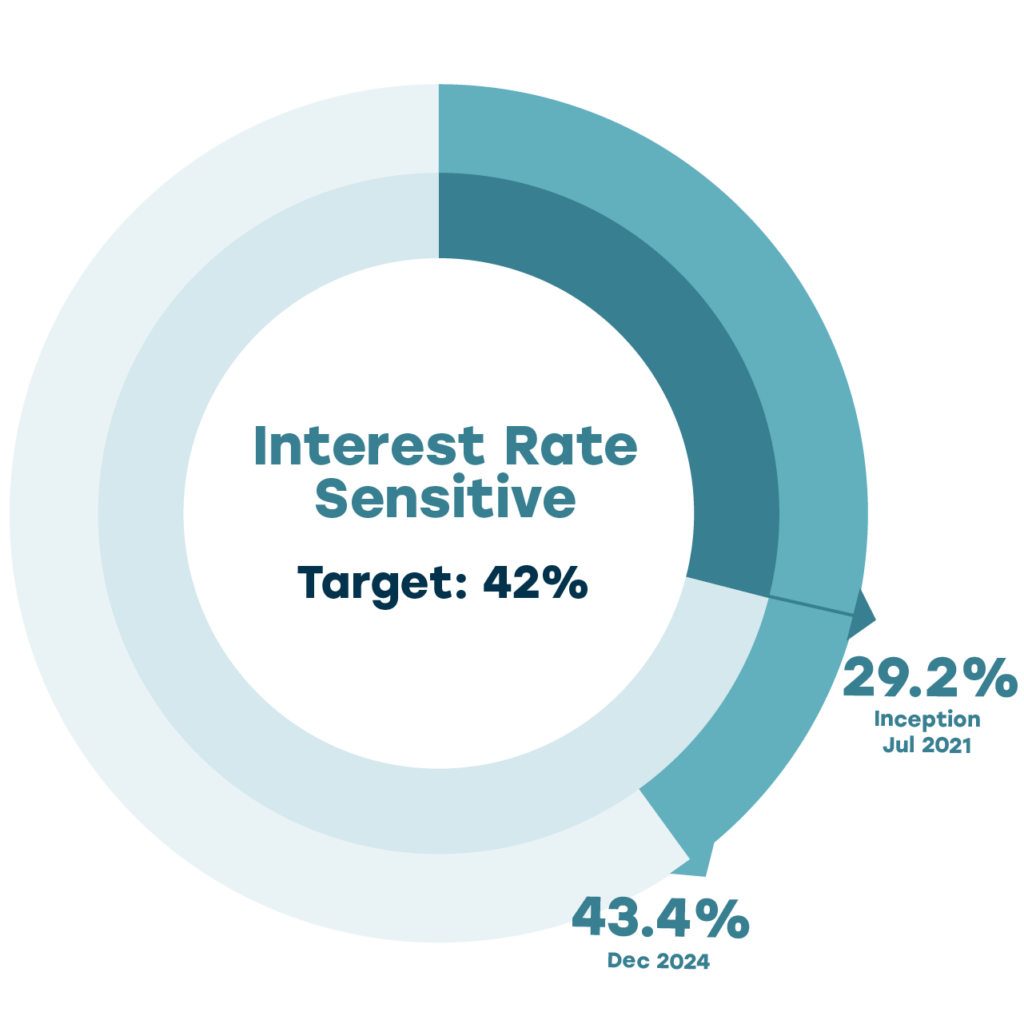

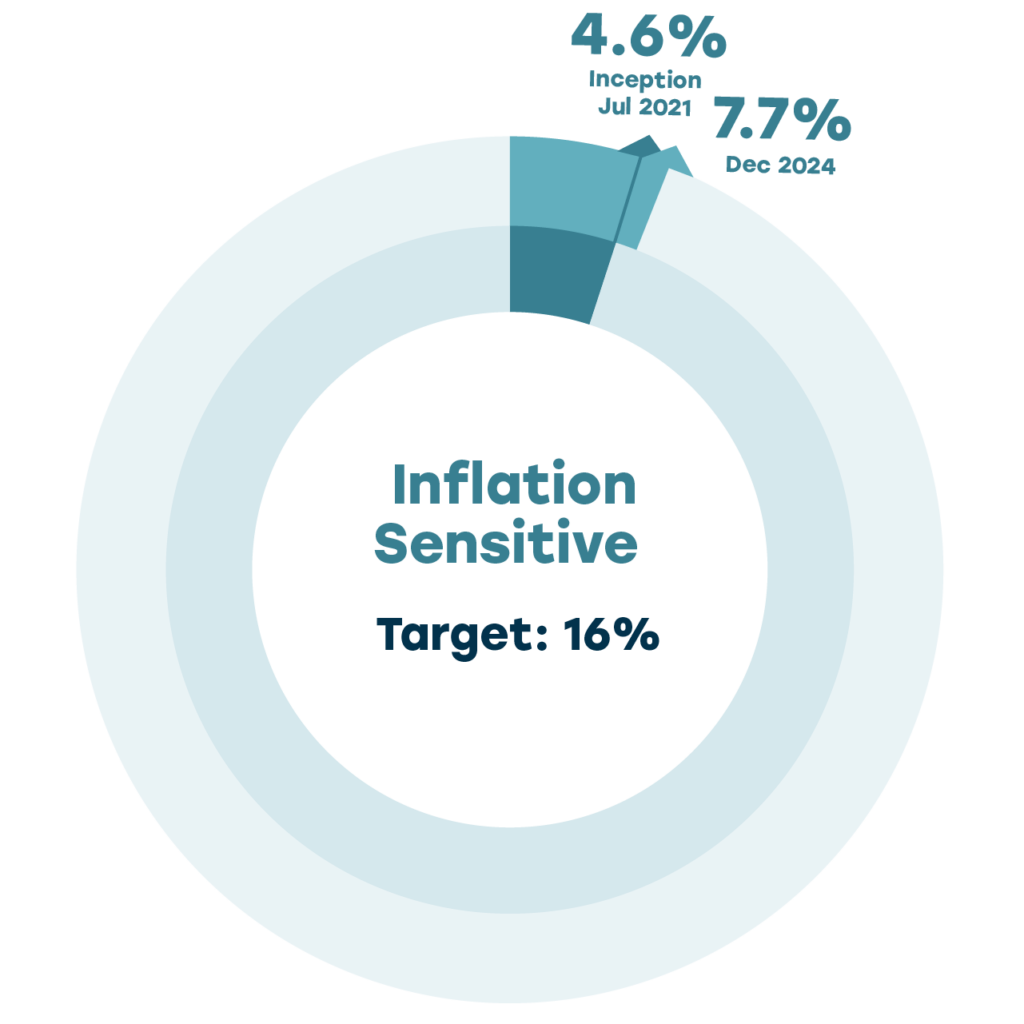

The Plan’s asset mix is diversified across a broad range of asset classes, organized in three categories: return enhancing, interest rate sensitive, and inflation sensitive. Under this structure, we divide our total fund assets based on their exposure to key economic drivers as well as their risk-return characteristics and roles in funding the pension.

In line with our target asset mix, we explore new investments with a focus on enhanced cost efficiency and control, alignment with our members’ needs, and long-term value.

Since embarking on our portfolio transition journey, we have made significant progress in shifting our exposure toward certain asset classes. In 2024, we further reduced our exposure to public equities and increased our investments in interest rate–sensitive assets. We also increased our allocation to inflation-hedging assets, including investing in renewable energy, digital infrastructure, and multi-residential real estate. These shifts support better portfolio alignment with our investment approach and pension liabilities. We continuously explore new investments that reflect this priority.

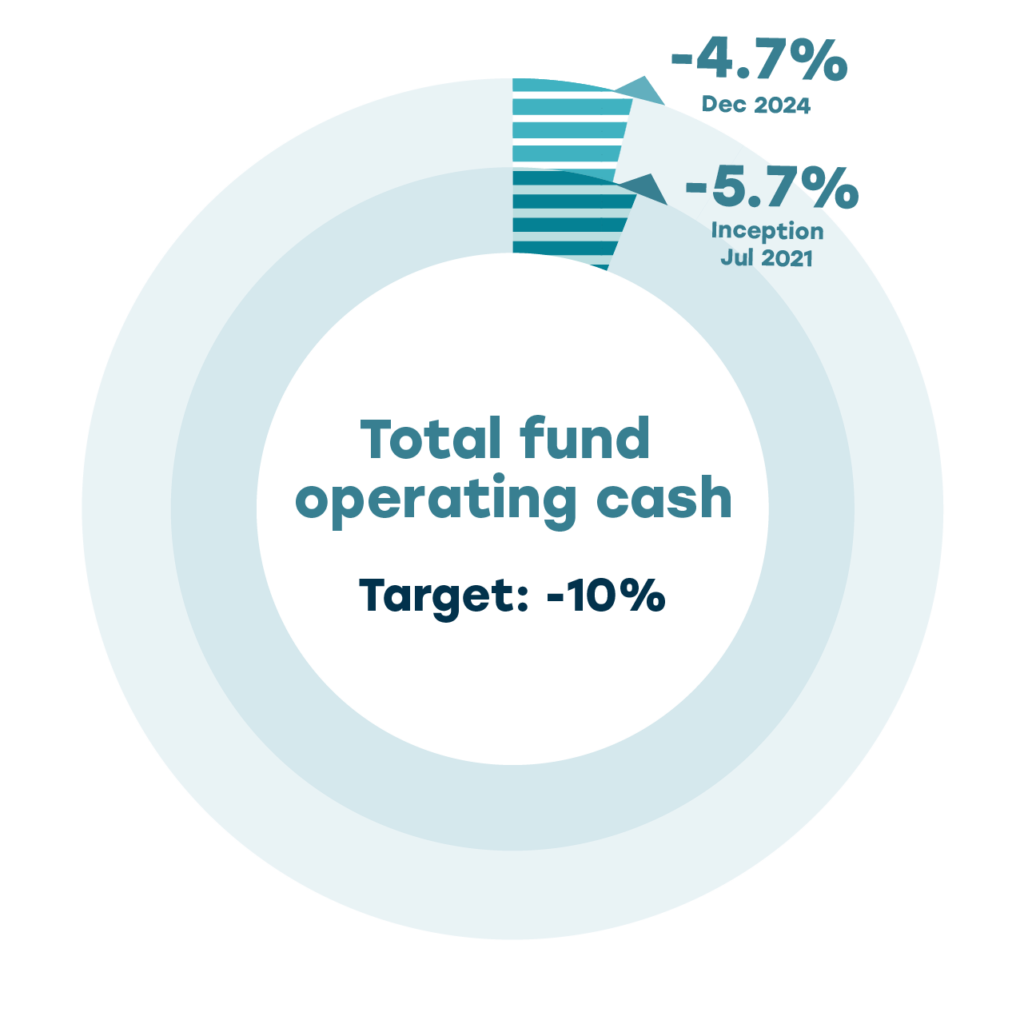

Inception July 1, 2021 – December 2024

Return enhancing strategies: generally reduce funding risk over the long term by delivering higher relative rates of return. They can, however, display higher relative volatility (a measure of market risk) in the short term.

Asset subclasses: public equities, private equities, private debt, absolute return.

Interest rate sensitive strategies: generally reduce funding risk over the long term by helping offset the effects of changing interest rates to our assets and liabilities. This includes long-dated government bonds, which are a stable source of long-term returns and help align our fixed income portfolio with the interest rate sensitivity of our liabilities.

Asset subclasses: fixed income, inflation sensitive bonds

Inflation sensitive strategies: provide stable long-term returns while helping mitigate the impact of inflation on the long-term value of the Plan liabilities, which are linked to salary levels and partially indexed to changes in inflation.

Asset subclasses: infrastructure,

real estate

Total fund operating cash: helps us dynamically change our exposures in a fast-moving market. Proactive liquidity planning ensures we can maintain our desired asset mix and meet our liability obligations while remaining a reliable source for markets when liquidity is scarce.

GEPE II is managed by Greystar, a residential real estate operator with deep expertise in multi-family and student housing in Europe. Our commitment provides exposure to assets characterized by strong long-term demand and occupancy, as well as inflation-adjusted income. GEPE II diversifies our portfolio, provides inflation-protected returns, and strengthens UPP’s ability to provide our members with stable and reliable pensions. Additionally, the fund’s focus on student housing reflects our commitment to the university sector.

Nine Masts Investment Fund (NMIF) is a multi-strategy, multi-manager fund focused on arbitrage and relative value opportunities in Asia across asset classes. The fund aims to deliver steady, uncorrelated returns with controlled drawdowns, supported by active capital allocation and strong risk management. The addition of NMIF to the portfolio is anticipated to contribute to lower overall volatility and improved risk-adjusted returns over the long term.

UPP’s commitment to the Real Estate Gateway Fund reflects our strategy to build an income-generating real estate portfolio through strong partnerships in key markets. The fund, managed by Schroders Capital, offers inflation-adjusted returns and stable income from industrial assets in the Netherlands. It is also classified as an Article 8 fund under the EU’s Sustainable Finance Disclosure Regulation, which means the fund promotes environmental and social characteristics. This helps UPP provide reliable, long-term returns for our members’ pensions that are aligned with our Climate Action Plan. Read more about the investment here.

As part of a broader partnership with CIP, UPP made an anchor commitment to GCF II, which provides senior secured, asset-backed loans to energy transition and renewable power projects in sectors such as solar, wind, and storage across North America, Western Europe, and Asia Pacific. Classified as an Article 9 fund under the EU’s Sustainable Finance Disclosure Regulation, GCF II supports energy sector decarbonization, advancing UPP’s Climate Action Plan while offering stable, risk-adjusted returns to benefit members.

This discretionary macro strategy targets 10 to 15 medium- to long-term themes in Asian markets (e.g. Singapore dollar appreciation, increase in short-term Australian rates), primarily investing in foreign exchange, rates, and credit markets. It aims to deliver risk-adjusted, absolute returns that are uncorrelated with the rest of the Plan’s portfolio. RV Capital carefully manages risk throughout its investment process, including consideration of financially material environmental, social, and governance factors, supporting UPP’s goal of providing stable and secure pensions for its members.

As part of UPP’s objective to form strategic partnerships with sector experts, UPP has entered a joint venture with U.S. industrial real estate specialist WPT Capital Advisors, which provides access to warehouse and logistics real estate assets across major U.S. supply-chain and distribution markets. This investment combines WPT’s specialized expertise with UPP’s desire for portfolio diversification and inflation-protected, long-term investments that can strengthen pension security for members. Read more about the investment here.

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

Customize your experience through accessibility adjustments