UPP President and CEO

UPP Board Chair

UPP President and CEO

A message from the CEO

I am thrilled to share this annual report, providing a snapshot of UPP’s pivotal first year as Ontario’s newest jointly sponsored pension plan, and the first tailored by and for Ontario’s university sector.

At the start of UPP’s decade-long journey, those involved—university unions, faculty associations, administrators, and other staff groups —likely each had many goals, but one common vision: retirement security tailored for the entire Ontario university community. Through many years and extensive negotiations, our founders never lost sight of their vision, and worked tirelessly to bring it to fruition.

I, and the entire team at UPP, are deeply inspired by their ingenuity and determination, and honoured to continue their work and deliver our shared vision.

UPP Board Chair

A message from the Chair

It is my great privilege and pleasure to introduce UPP’s first annual report, marking another milestone along a remarkable journey.

You will see that this inaugural report, capturing the Plan’s first six operating months from July 1 to December 31, 2021, reflects a period of profound transition and foundation building. As our organization and capacity grow and evolve in service of our members present and future, so too will our reporting. This time next year, we will have had a full year of operations and will introduce more information into our annual report with that fuller experience.

We have much to share about how far we have come since the Plan’s inception and about our vision for the exciting road ahead.

Fully funded with sustainable pension security at the core

At December 31, 2021

111%

Fully funded

$1.2B

Funding surplus

$254M

Total pension benefits paid in the last half of 2021

01

A decade in the making

Employees and employers came together to build UPP. We would like to recognize the extraordinary efforts of this plan’s founders. It is our privilege to continue their work.

2009

Discussions begin between university unions, faculty associations, administrators, and other staff groups about customizing a JSPP to reshape and sustain the retirement income system in the Ontario university sector.

2014-2015

2016-2017

Deep discussions happen among university administration, faculty associations, unions, and non-unionized staff on UPP’s organizational structure, terms, and participants. Three initial university partners and associated unions and faculty associations step forward as UPP’s founding participants, with the plan for others to join over time.

2018

2019

Pension plan members at the founding universities consent to convert their existing plans to UPP, through a transfer of assets and liabilities. The Joint Sponsors adopt UPP’s Funding Policy, including an innovative risksharing arrangement for past service and future service liabilities.

2020

July — Barbara Zvan is appointed as UPP’s inaugural President and CEO.

November — UPP receives formal solvency funding exemption as a JSPP.

July 1st, 2021

UPP becomes the official pension provider for the founding participants and their 37,000+ members.

January 1st, 2022

STRATEGIC PILLARS

Serve our members

Deliver proactive, digitally enabled services that exceed member expectations

Invest for the future

Design a dynamic, purpose-driven investment program with pension security at the core

Realize sector growth

Build trust and transparency with the diverse university community and welcome new Plan participants

END-TO-END FOUNDATIONS

Build for Resilience

Future-proof operations and technology while responsibly managing costs

Lean Into ESG1

Foster a financially, socially, and environmentally sustainable future for members in all we do

Foster our culture

Build an intentional, thriving culture underpinned by our purpose-driven people

02

Our commitment to equity, diversity, inclusion, and reconciliation

Our people are the heart of our organization

Together, we are creating a purpose-driven and inclusive workplace with a culture of teamwork, collaboration, and respect — for one another and the world around us. Equity, Diversity, Inclusion, and Reconciliation (EDIR) is the umbrella term for the programs, policies, strategies, and practices underpinning our mission to create and sustain a diverse, equitable, and inclusive environment – no matter anyone’s ethnicity; sexual orientation; gender identity; physical, cognitive, or mental ability; religion; age; marital status; socioeconomic status; national origin; or other identities.

EDIR is not just a core value at UPP; it’s a business imperative. Diverse teams, perspectives, and lived experiences contribute to better decisions and a better workplace. Our EDIR program and three-year roadmap are the blueprints for our inclusive, respectful working environment and our way of honouring the Truth and Reconciliation Commission’s Call to Action #92

Learn more about our EDIR strategic objectives in our annual report

03

Serving our members

37,084

Members

19,818

Active

11,935

Retired

5,331

Deferred

A member-driven approach

UPP was founded with a promise to preserve a comfortable and secure retirement income for our members, deliver member service excellence, and give our members a voice in their plan.

We are at a pivotal stage — building our long-term foundations, defining our member experience and engagement approach, and solidifying our investment roadmap. With an exciting road of opportunity ahead at UPP, our members’ direct perspectives, expectations, and priorities are an essential compass.

04

Invest for the future

6-month investment highlights

(At December 31, 2021)

$11.8B

Net assets

5.7%

Net return

$0.6B

Net investment income

UPP investment beliefs

We believe that long-term sustainable growth depends on action grounded in strong, clear values. At UPP, all investment strategies and decisions are guided by the following Investment Beliefs, as set by Management and the Board in early 2022.

UPP invests with a purpose: to fulfill the pension promise to members, now and in the future.

As a long-term investor, UPP has a responsibility to promote the health of the capital markets and the financial, social, and environmental systems on which capital markets rely.

Creating value and managing risk involve exercising UPP’s voice to influence outcomes related to material issues through active ownership, policy advocacy, and collaboration with other investors and stakeholders — all of which must be approached with the same intention and rigour as selecting investments.

All aspects of investing should be forward-looking and intentional. Successful investing requires rigorous research and analysis, alignment with UPP’s capabilities, and focused innovation.

Culture is an essential investment input. How we invest should reflect UPP’s culture of collaboration and forward vision.

UPP embraces partnership as a foundation for enhanced performance and impact.

Costs are an asset that should be treated as judiciously as any other plan asset. The goal is neither to reduce costs to the lowest possible level, nor squander a plan asset. Rather, the goal is to employ costs wisely in delivering a secure pension promise.

Transparency engenders trust. Our investment of members’ pension earnings has bearing on their retirement security; they have a right to know how we approach and perform that responsibility.

05

Leading with sustainability

Promoting the health of financial, social, and environmental systems

As a long-term investor, UPP has a responsibility to promote the health of the capital markets and the financial, social, and environmental systems on which capital markets rely. This value is embedded in our core investment beliefs and approach, as a means for fulfilling our pension promise well into the future.

Creating value and managing risk

End-to-end ESG integration

Our ESG focus extends to the highest level at UPP and is embedded throughout the organization. Every investment professional is responsible for integrating ESG considerations into their investment decisions and communicating UPP’s policies and expectations to external investment managers. We do this to deliver sustainable long-term value and fulfil our pension promise to generations of members.

Our suite of investment policies provides a framework for how we will consistently and comprehensively incorporate ESG considerations in our investment management and stewardship activities. These policies will continually evolve as we grow and advance our investment program, driven by our steadfast commitment to the pension promise.

Exercising our influence and partnering for impact

By investing in companies and establishing relationships with external managers, we gain a seat on the table that we can use to promote fair, efficient, and sustainable financial markets. We engage in proactive dialogue with the companies we invest in and our external investment managers to make our expectations clear on ESG issues such as climate change, reconciliation, and human rights.

UPP participates in broader collaborative initiatives to:

- Leverage the power of scale to amplify our impact

- Enhance access to global tools, data, and best practices

- Help deliver a strong, unified voice to companies about material matters

UPP's climate action plan

Part of being a responsible investor is advancing climate readiness across our portfolio. This is critical not only to the success of Canadian companies and communities as we move toward a net zero world, but also the long-term strength of our Fund. Recognizing climate change as a defining challenge of our time, a transparent and deliberate climate action plan is and will be a priority component of our developing investment and risk management strategy.

UPP will transition its investment portfolio to

Net-zero

GHG emissions by

2040

or sooner

with interim emissions reduction targets:

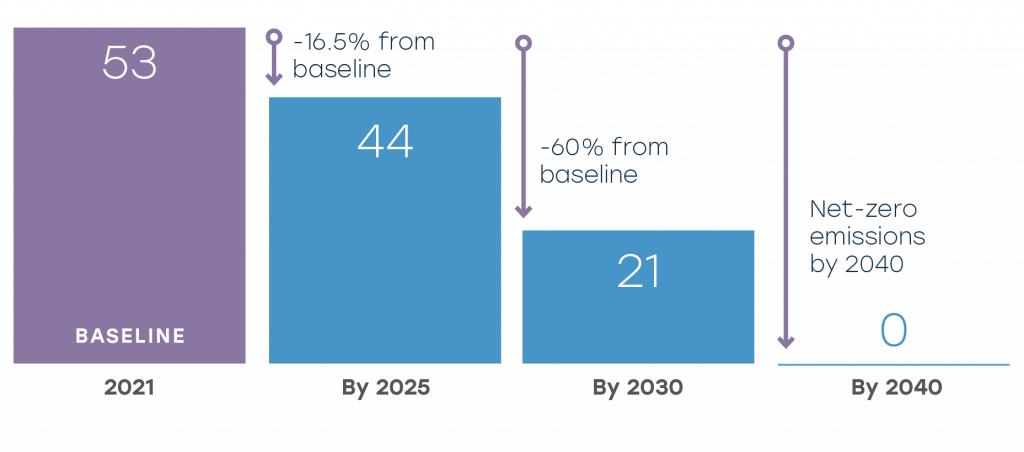

16.5% by 2025

60% by 2030

Our inaugural carbon footprint also forms the baseline for our interim emission reduction targets, as shown below. We will calculate and report our carbon footprint annually to demonstrate progress toward our long-term objective of net-zero portfolio GHG emissions by 2040 and our interim 2025 and 2030 emission reduction objectives.

UPP’s 2021 carbon footprint and targets

Metric tonnes CO2-eq/$M invested

While setting a 2040 net-zero target may seem ambitious for a new fund, we see this commitment as central to delivering long-term value and an essential beacon for our evolving investment strategy.

Our Climate Action Plan outlines the steps and tools we will take to achieve our target.

Tell us what you think about this summary.

Learn more

More details on who we are, plan funding, and investment performance

Part of being a responsible investor is advancing climate readiness across our portfolio. UPP will transition its investment portfolio to Net-zero GHG emissions by 2040 or sooner. Our Climate Action Plan outlines the steps and tools we will take to achieve our target.

As a jointly sponsored pension plan, the perspectives and ideas of our plan members are a crucial input into shaping UPP’s path forward. Read the results of our engagement activities to date, featuring survey results, key themes and important takeaways.